Quality of life tax cut for my frind Clint:

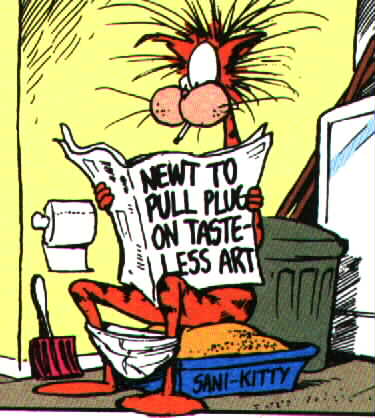

Another $70 billion tax cut was recently passed. The Center on Budget and Policy Priorities says the average middle-income household will get a $20 tax cut. Oh boy!

Those making more than $1 million a year will get nearly $42,000.

Damn, you're right. Love that quality of life statement by conservative governance. But at least it's a plan, you'll say.

Some plan. Now if only we could win the lottery.

USA Wins Olympic Hockey Gold Medal In OT Vs Canada

-

Lead by an incredible performance by USA goalie Connor Hellebuyck and a

magical overtime golden goal by Jack Hughes, the USA Mens hockey team upset

the p...

2 hours ago

I totally agree -- Just what should I do with the estimated $15.00 I should be getting back? Hmmm, oh, I know. I can buy four gallons of gas and a pack of gum!

ReplyDeleteHow about the state of Wisconsin...You still won't answer the question.

ReplyDeleteI did in a previous post, though I will add that property taxes are high in my opinion.

ReplyDeleteSo what? Your solution is to gut the consitution. Mine is to let voters decide. If you were more confident that others believed the drivel that you do, then you guys wouldn't be taking the amendment route.

But you know you don't have a majority and never will, because most people are decent and care about the general welfare of others ... not welfare the way you think of it ... but the good of community. You guys are just plain selfish. Quit crying.

By the way, I've seen nothing original from you. Just copycat nonsense.

If you have seen nothing original then obviously you are need reading just skimming.

ReplyDeleteOf course I expect those insults from you since you can not debate on substance.

I did read. It was just "bootstrap" nonsense.

ReplyDeleteBy the way, what do you mean by teaching to the "lowest common denominator?" Hmmm.

Sounds like code to me.

Hey, just a little interjection -- I lived in Illinois from age 5 until I moved up to the great state of Wisconsin seventeen years ago (and no, I won't tell you how old I am). I was told that people in Wisconsin paid high taxes. My first year here, I earned less and paid more to the state of Illinois than I did to Wisconsin. I'm still paying less in property taxes -- one reason is because in our state, the houseing costs have not been adjusted at such an alarming rate as they have in Illinois.

ReplyDeletePlus, don't care if I pay high taxes. I have a great response from my police department, I'm assuming that would go for the fire department and my roads are pretty nice.